Investment strategy

Donations to the Acorn Foundation are pooled and invested in perpetuity, so that they can grow over time and contribute to our community for years to come. Though donations are pooled, each donor fund is tracked and recorded individually. The investment returns are used to make distributions to local community organisations each year, in accordance with each donor’s wishes.

Our key driver, therefore, is to preserve the original capital value of a gift and grow our assets as much as market conditions allow, so that we can:

- Invest in programs that address community needs now; and

- Ensure there will be resources available to address community needs in the future.

Investment objectives

The investment objectives of the Fund are:

- To preserve the nominal value of the Fund, with a preference for maintaining the real value over time;

- To generate sufficient return within the Fund on a rolling annual basis to:

- Cover the administration expenses of the Fund, including the Investment Manager;

- Contribute to the operating expenses of the Foundation; and

- Provide sufficient long term returns to enable the Foundation’s charitable distributions.

- The expected long-term gross return objective of the Fund, based on the asset allocation, is 5.2%. Return volatility means this will not be achieved every year, but this is the target on a rolling 5-year basis, measured on weighted average funds under management over that period.

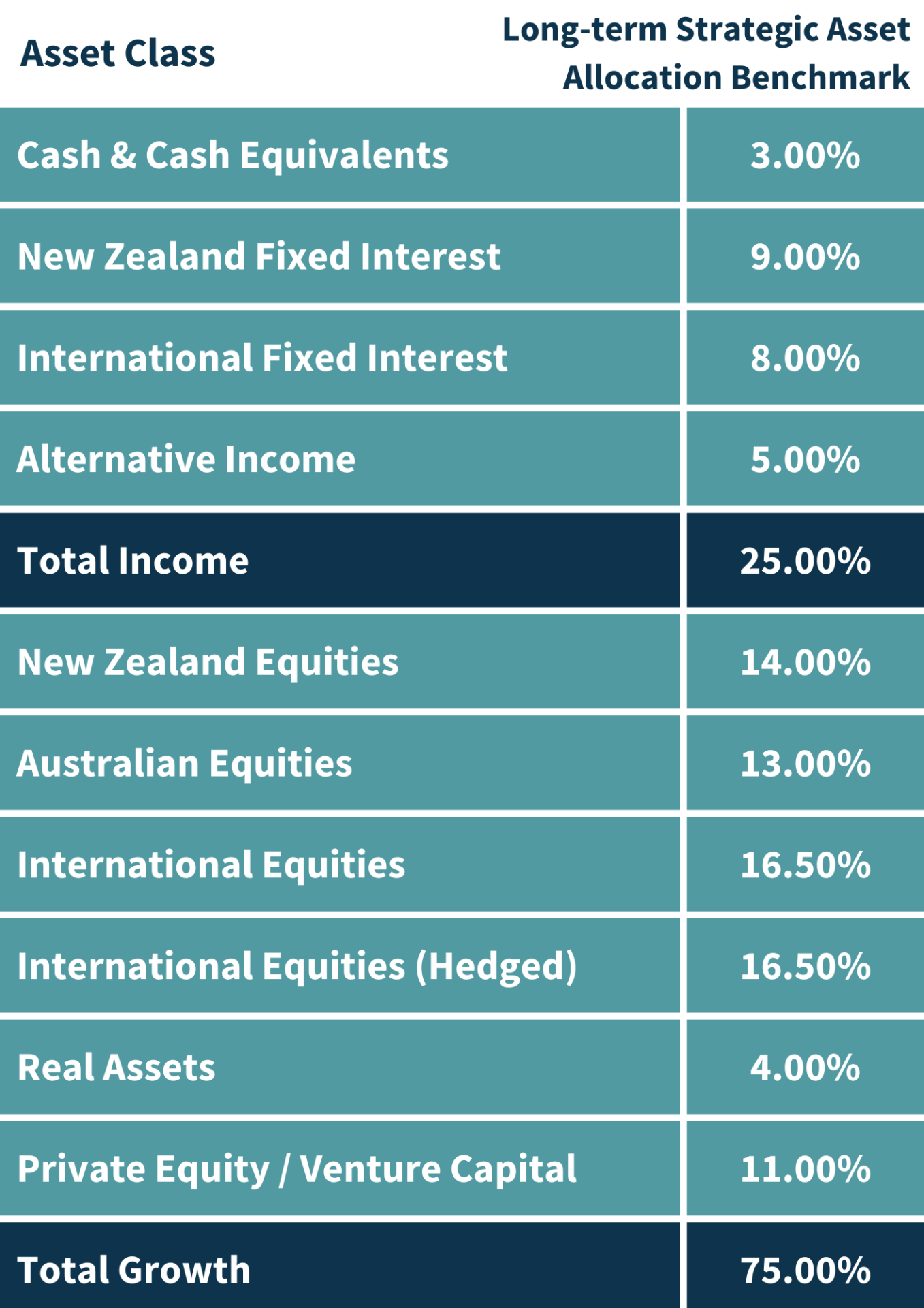

Asset allocation

Asset allocation is undertaken in a way that reflects the Foundation's investment objectives and corresponding risk profile.

- The primary role of the Fixed Income and Cash allocation is to provide regular income and support the preservation of capital.

- The primary role of the New Zealand, Australian and global equity holdings is to provide sustainable income, growth in income over time, or capital growth.

- The primary role of the Property allocation is to provide sustainable income and growth in income over time.

- The primary role of alternative assets is to provide investment returns that are less correlated to listed financial market returns. They provide important diversification of systematic risk, as well as return contribution.

Investment management and performance

The Fund is currently managed by Craigs Investment Partners, under the authority of the Acorn Foundation Investment Advisory Committee. This means all investment decisions must be approved by the Investment Advisory Committee, who are appointed by Acorn's Board of Trustees. Investment decisions made by the Investment Advisory Committee ensure adherence to Acorn's Investment Policy.

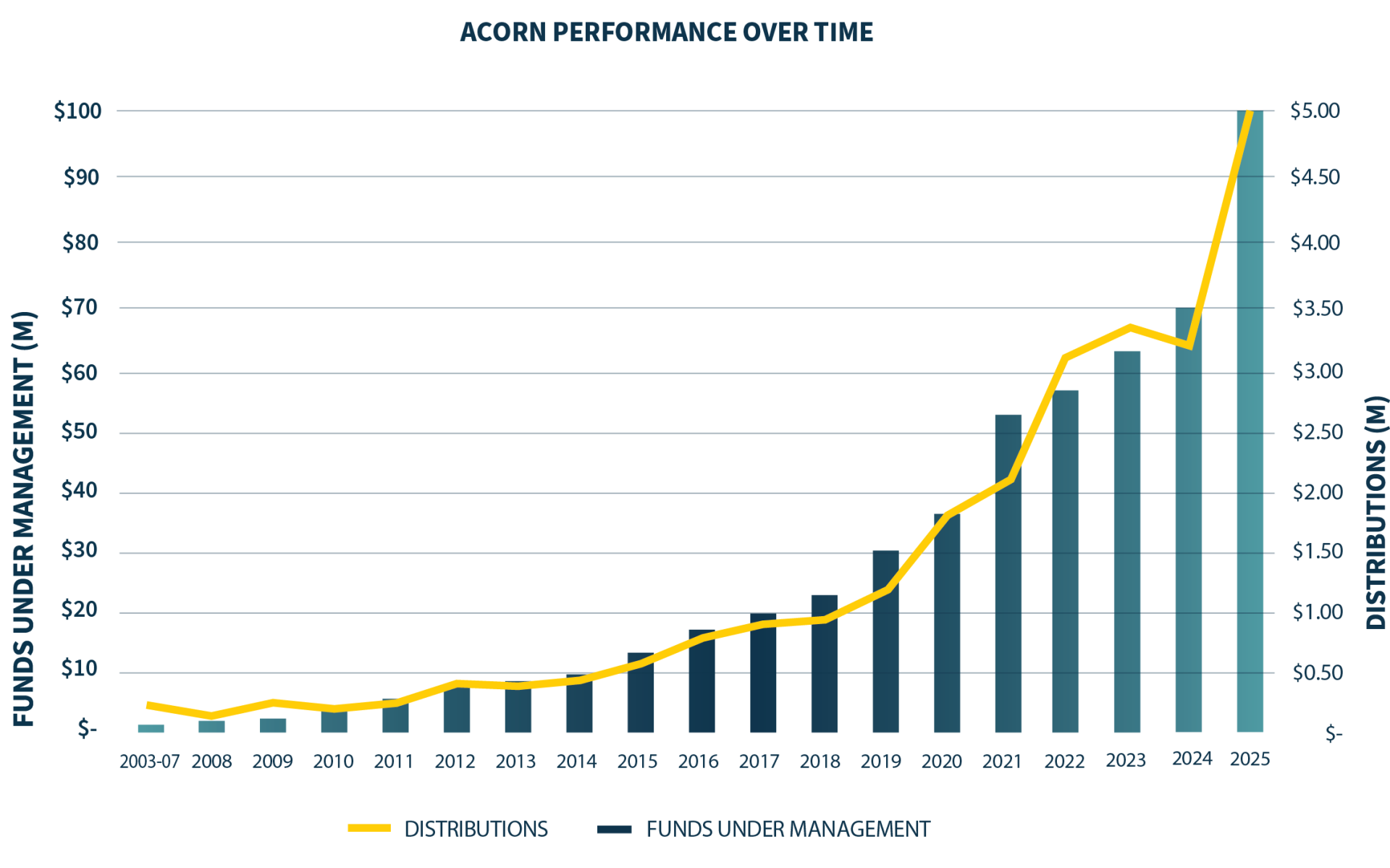

Our portfolio has grown from our first fund in 2003 of $67,000 to $100M in June 2025. Over the past 10 years, our portfolio has seen an annualised gross rate of return of 8.01%, while the annualised net return is 7.30%.

For more detailed information on annual fund performance, view our Annual Reports.

Investment beliefs

Acorn Investment Beliefs, as updated in 2021:

- Diversification within and across asset classes is a critical risk management mechanism.

- The strategic asset allocation (or asset mix) decision is the most important factor in determining investment return and risk in the long-term.

- Whilst less predictable in the short to medium term, asset classes tend to deliver predicable returns over the long-term.

- Acorn’s investment horizon is long-term in nature, and therefore it can ride out volatility that may impact short-term investment performance.

- Regular portfolio rebalancing helps to maintain an appropriate level of risk exposure.

- Tactical asset allocation (or market timing) cannot be expected to consistently add value in the long-term.

- Quality assets are a crucial element of risk control in a portfolio. Risk of permanent loss of capital should be minimised to the extent possible.

- Where active management is determined not to add value, such as in markets deemed to be highly efficient, passive management is the default choice.

- Costs (administration, investment management fees, custodial fees, etc.) have a significant impact on long-term results and need to be carefully monitored and controlled to ensure value.

- Investments should consider the contribution or impact to environmental, social and governance factors.

Social responsibility

The Acorn Foundation Fund is managed with a Socially Responsible Investment framework which reflects the Foundation’s Vision. The fund will endeavour to exclude investments in alcohol, armaments, tobacco, pornography, and gambling.

View the Acorn Foundation's Responsible Investment Policy here.

Learn more about our Smarter Giving Model

Find out how to make your charitable giving go further.